td: R Access to twelvedata

Motivation

twelvedata provides a very rich REST API, see the documentation. While a (free) login and a (free, permitting limited but possibly sufficient use) API key are required, the provided access is rich to set up simple R routines. This package does that.

Example

Here we are running (some) code from shown in

example(time_series)

> library(td)

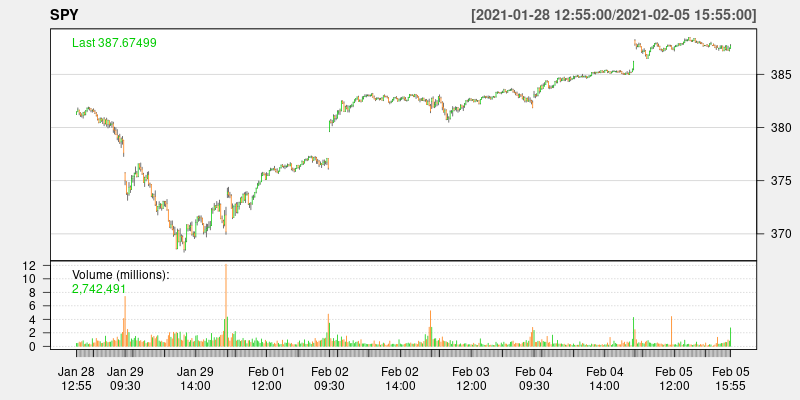

> data <- time_series("SPY", "5min", outputsize=500, as="xts")

> if (requireNamespace("quantmod", quietly=TRUE)) {

> suppressMessages(library(quantmod)) # suppress some noise

> chartSeries(data, name=attr(data, "symbol"), theme="white") # convenient plot for OHLCV

> }retrieves an xts object (provided xts is installed) and

produces a chart like this:

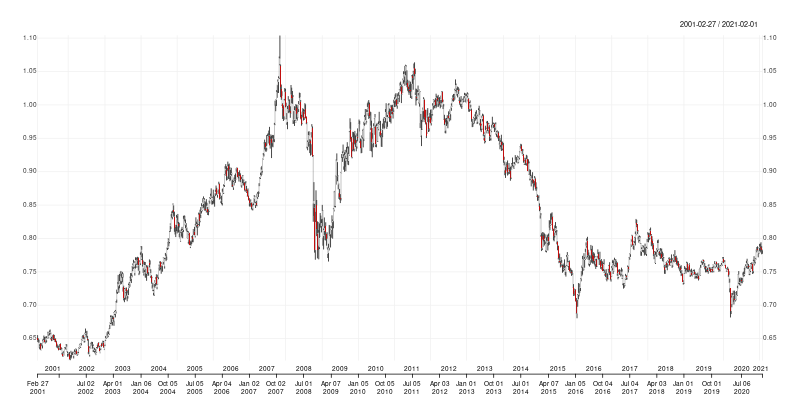

The package can also be used without attaching it. The next example

retrieves twenty years of weekly CAD/USD foreign exchange data using a

direct td::time_series() call with having the package

loaded. The API key is automagically set (if it is in fact provided

either in the user config file or as an environment variable). Also

shown by calling str() on the return object is the metadata

attach after each request:

> cadusd <- td::time_series(sym="CAD/USD", interval="1week", outputsize=52.25*20, as="xts")

> str(cadusd)

An ‘xts’ object on 2001-02-27/2021-02-01 containing:

Data: num [1:1045, 1:4] 0.651 0.646 0.644 0.638 0.642 ...

- attr(*, "dimnames")=List of 2

..$ : NULL

..$ : chr [1:4] "open" "high" "low" "close"

Indexed by objects of class: [Date] TZ: UTC

xts Attributes:

List of 6

$ symbol : chr "CAD/USD"

$ interval : chr "1week"

$ currency_base : chr "Canadian Dollar"

$ currency_quote: chr "US Dollar"

$ type : chr "Physical Currency"

$ accessed : chr "2021-02-06 15:16:29.209635"

> As before, it can be plotted using a function from package quantmod; this

time we use the newer chart_Series():

> quantmod::chart_Series(cadusd, name=attr(data, "symbol"))

As the returned is a the very common and well-understood [xts]

format, many other plotting functions can be used as-is. Here is an

example also showing how historical data can be accessed. We retrieve

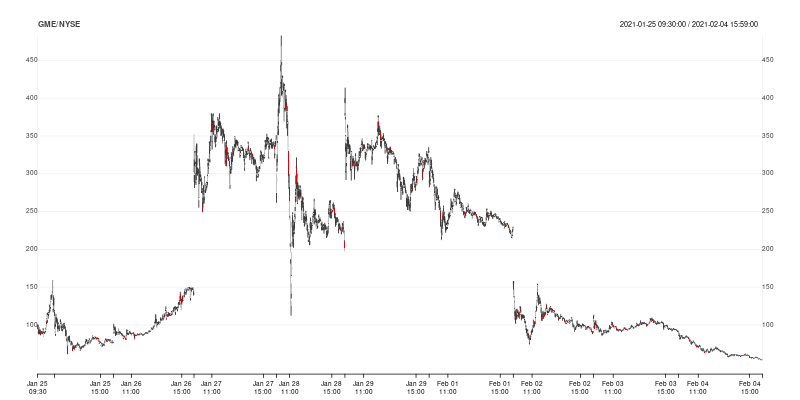

minute-resolution data for GME during the late January /

early February period:

> gme <- time_series("GME", "1min",

+ start_date="2021-01-25 09:30:00",

+ end_date="2021-02-04 16:00:00", as="xts")Note the use of exchange timestamps (NYSE is open from 9:30 to 16:00 local time).

We can plot this again using quantmod::chart_Series()

showing how to display ticker symbol and exchange as a header:

> quantmod::chart_Series(gme, name=paste0(attr(gme, "symbol"), "/", attr(gme, "exchange")))

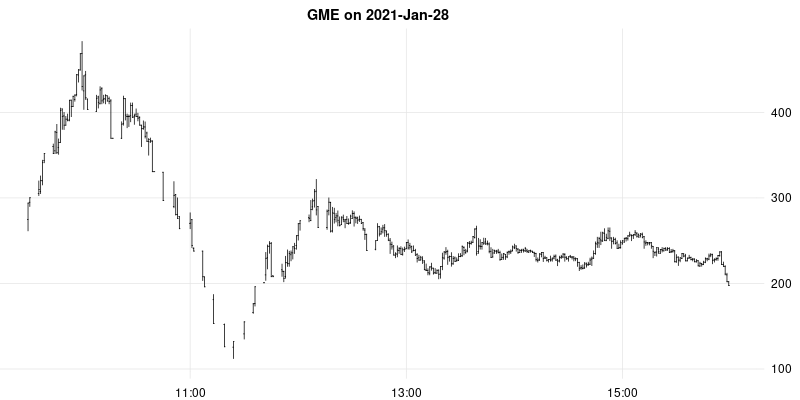

Naturally, other plotting functions and packages can be used. Here we

use the same dataset but efficiently subset using a key

xts feature and fed into CRAN package rtsplot and

requesting OHLC instead of line plot.

> rtsplot::rtsplot(gme["20210128"], main="GME on 2021-Jan-28", type="ohlc")

Status

Still fairly new and fresh.

We also note that the package is not affiliated with twelvedata. For an officially supported package, see their twelvedata-python package.

Contributing

Any problems, bug reports, or features requests for the package can be submitted and handled most conveniently as Github issues in the repository.

Before submitting pull requests, it is frequently preferable to first discuss need and scope in such an issue ticket. See the file Contributing.md (in the Rcpp repo) for a brief discussion.

Author

Dirk Eddelbuettel

License

GPL (>= 2)