Updated overbought/oversold plot function

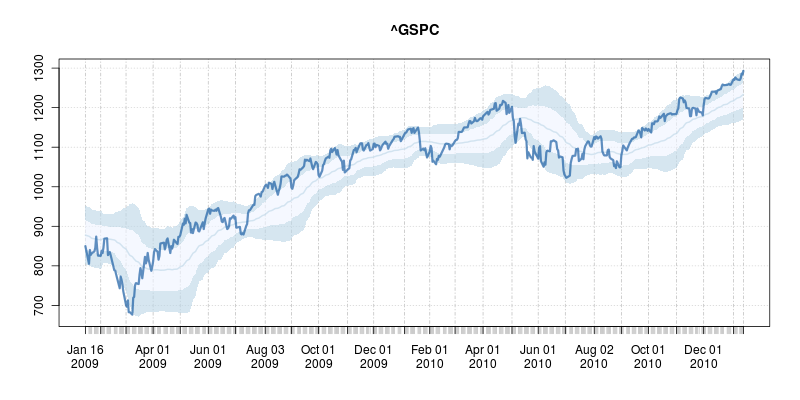

A good six years ago I blogged about plotOBOS() which charts a moving average (from one of several available variants) along with shaded standard deviation bands. That post has a bit more background on the why/how and motivation, but as a teaser here is the resulting chart of the SP500 index (with ticker ^GSCP):

The code uses a few standard finance packages for R (with most of them maintained by Joshua Ulrich given that Jeff Ryan, who co-wrote chunks of these, is effectively retired from public life). Among these, xts had a recent release reflecting changes which occurred during the four (!!) years since the previous release, and covering at least two GSoC projects. With that came subtle API changes: something we all generally try to avoid but which is at times the only way forward. In this case, the shading code I used (via polygon() from base R) no longer cooperated with the beefed-up functionality of plot.xts(). Luckily, Ross Bennett incorporated that same functionality into a new function addPolygon --- which even credits this same post of mine.

With that, the updated code becomes

## plotOBOS -- displaying overbough/oversold as eg in Bespoke's plots

##

## Copyright (C) 2010 - 2017 Dirk Eddelbuettel

##

## This is free software: you can redistribute it and/or modify it

## under the terms of the GNU General Public License as published by

## the Free Software Foundation, either version 2 of the License, or

## (at your option) any later version.

suppressMessages(library(quantmod)) # for getSymbols(), brings in xts too

suppressMessages(library(TTR)) # for various moving averages

plotOBOS <- function(symbol, n=50, type=c("sma", "ema", "zlema"),

years=1, blue=TRUE, current=TRUE, title=symbol,

ticks=TRUE, axes=TRUE) {

today <- Sys.Date()

if (class(symbol) == "character") {

X <- getSymbols(symbol, from=format(today-365*years-2*n), auto.assign=FALSE)

x <- X[,6] # use Adjusted

} else if (inherits(symbol, "zoo")) {

x <- X <- as.xts(symbol)

current <- FALSE # don't expand the supplied data

}

n <- min(nrow(x)/3, 50) # as we may not have 50 days

sub <- ""

if (current) {

xx <- getQuote(symbol)

xt <- xts(xx$Last, order.by=as.Date(xx$`Trade Time`))

colnames(xt) <- paste(symbol, "Adjusted", sep=".")

x <- rbind(x, xt)

sub <- paste("Last price: ", xx$Last, " at ",

format(as.POSIXct(xx$`Trade Time`), "%H:%M"), sep="")

}

type <- match.arg(type)

xd <- switch(type, # compute xd as the central location via selected MA smoother

sma = SMA(x,n),

ema = EMA(x,n),

zlema = ZLEMA(x,n))

xv <- runSD(x, n) # compute xv as the rolling volatility

strt <- paste(format(today-365*years), "::", sep="")

x <- x[strt] # subset plotting range using xts' nice functionality

xd <- xd[strt]

xv <- xv[strt]

xyd <- xy.coords(.index(xd),xd[,1]) # xy coordinates for direct plot commands

xyv <- xy.coords(.index(xv),xv[,1])

n <- length(xyd$x)

xx <- xyd$x[c(1,1:n,n:1)] # for polygon(): from first point to last and back

if (blue) {

blues5 <- c("#EFF3FF", "#BDD7E7", "#6BAED6", "#3182BD", "#08519C") # cf brewer.pal(5, "Blues")

fairlylight <<- rgb(189/255, 215/255, 231/255, alpha=0.625) # aka blues5[2]

verylight <<- rgb(239/255, 243/255, 255/255, alpha=0.625) # aka blues5[1]

dark <<- rgb(8/255, 81/255, 156/255, alpha=0.625) # aka blues5[5]

## buglet in xts 0.10-0 requires the <<- here

} else {

fairlylight <<- rgb(204/255, 204/255, 204/255, alpha=0.5) # two suitable grays, alpha-blending at 50%

verylight <<- rgb(242/255, 242/255, 242/255, alpha=0.5)

dark <<- 'black'

}

plot(x, ylim=range(range(x, xd+2*xv, xd-2*xv, na.rm=TRUE)), main=title, sub=sub,

major.ticks=ticks, minor.ticks=ticks, axes=axes) # basic xts plot setup

addPolygon(xts(cbind(xyd$y+xyv$y, xyd$y+2*xyv$y), order.by=index(x)), on=1, col=fairlylight) # upper

addPolygon(xts(cbind(xyd$y-xyv$y, xyd$y+1*xyv$y), order.by=index(x)), on=1, col=verylight) # center

addPolygon(xts(cbind(xyd$y-xyv$y, xyd$y-2*xyv$y), order.by=index(x)), on=1, col=fairlylight) # lower

lines(xd, lwd=2, col=fairlylight) # central smooted location

lines(x, lwd=3, col=dark) # actual price, thicker

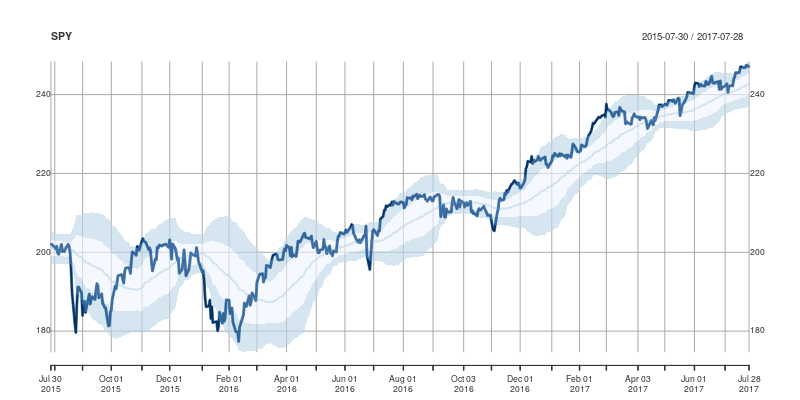

}and the main change are the three calls to addPolygon. To illustrate, we call plotOBOS("SPY", years=2) with an updated plot of the ETF representing the SP500 over the last two years:

Comments and further enhancements welcome!

This post by Dirk Eddelbuettel originated on his Thinking inside the box blog. Please report excessive re-aggregation in third-party for-profit settings.